DEBT/INFLATION/CRASH | The FED and The Facts Everybody Knows

Market Fundamentals - The debt and wealth economies.

This report is based on data, graphs, charts, and analysis from Greg Mannarino as well as many other authors IRUUR1 has shared previously on various media platforms

.Their conclusion is that everybody knows the economy will reach debt saturation, causing it to implode, and the markets to crash very soon, unless something significant and fundamental is done, to change direction immediately. Even the Banks and funds like the IMF, ECB, and BANK OF AMERICA are warning about it.

Everybody Knows

Everybody knows that allowing the issuance of unlimited debt by central banks is happening in conjunction with inflation, shortages, questionable government edicts, and international mandatory business policies.

Just like everybody knows the song Everybody Knows, by Leonard Cohen. Here is a verse from the late Leonard Cohen’s song that is very, applicable to the current troubles of the debt-based economic system, the culture it engenders, and the leadership it empowers.

Everybody knows that the boat is leaking

Everybody knows the captain lied

Everybody got this broken feeling

Like their father or their dog just died

Everybody talking to their pockets

Everybody wants a box of chocolates

And a long-stem rose

Everybody knows

Addiction To Debt; Break It, Or It Breaks You

It is difficult to learn to live well in a wealth economy, so our leaders have guided us and legislated us into a debt economy, that draws money from the future, to be paid back later.

The Captain Lied: Everybody knows that every president has been increasing the US debt while saying they needed to borrow more money to solve an official crisis and pay the debt down at the same time. It has never worked for us Everybody knows each nation has done this. This money, as everybody knows, is now currently printed by and owed to central banks around the world, such as the Federal Reserve in the U.S. Everybody knows the United States is the largest debtor nation in world history, and that this can only be allowed for a short time longer before debt issuance reaches a saturation point and the current debt-based economy collapses.

TERMS OF DEBT.

Everybody knows that the dice are loaded

Everybody rolls with their fingers crossed

Everybody knows the war is over

Everybody knows the good guys lost

Everybody knows the fight was fixed

The poor stay poor, the rich get rich

That's how it goes

Everybody knows

The dice are loaded. We are currently forced to transact all exchanges with units of debt, printed by and owed to global central banks of the various nations. We are under Federal Reserve jurisdiction and like other nations, are forbidden from transacting outside of this ownership currency structure in any way. authorities deem questionable. All transactions outside of debt currencies for any and all goods and services, even beyond illegal things like drugs and stolen property, can be considered suspicious by authorities and can be the subject of criminal investigations.

The Central Bank’s Origins and Operations

The central banks weren’t just invented as a handy way for governments to allow folks to fund programs on credit through legislation and then pay back the treasury. The central banks were offered as an instrument of finance, to governments. This central bank instrument was extended by large land, trade, and other intellectual asset owners. The object was to lend a vast amount of money, from those assets, not easily paid back and balanced by dependable treasury receipts, overtime, alone.

War, famine, health, and other emergencies have often been borrowed against. This is why we pay interest on the debt to central banks, which are private institutions with both public and private books. The central banks today are the financial instruments of those who control in some way the majority of the world’s known hard and intellectual assets. The Central Banks’ only power is to print debt, and they only gain more power by printing more debt.

Waiting For The Reset Or Choosing To Reset | Two Hard Directions

Building and living in a wealth economy as opposed to a debt economy can be tricky at any time. At this time there is what has been termed a war by central banks on the wealth economy, to own all of the world’s assets. Whether it’s a war or the inevitable result of a debt-based system, this transfer of wealth to the richest 1% accelerated in 2008 with Too Big To Fail, featuring bailouts for large corporate, and other major interests. Perhaps 30% or more, however, of actual hard and intellectual assets, may still remain under the control of middle-class families, businesses, and individuals. However the wealth transfer from the middle class. is accelerating every day.

Choosing the Central Bank’s WEF Advocated, Great Reset Future

The only likely result of allowing wealth transfer to continue and the debt economy to crash is a complete transfer of power to the banks. The Great Reset will be triggered in the debt market, reflected by a complete loss of value to our current free-market or wealth-driven economy along with unpayable debt. Then the banks will reset the terms of social economic existence with a new economic structure.

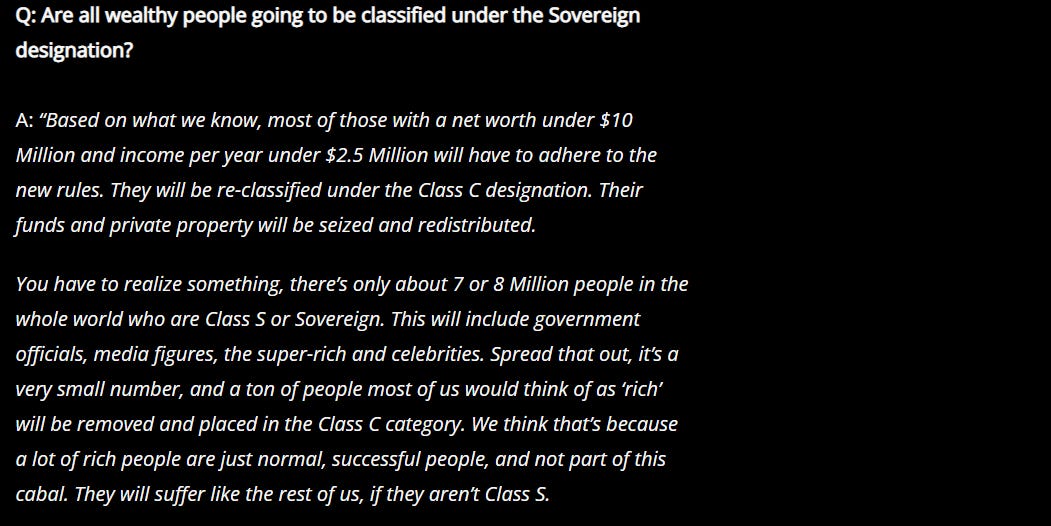

Whether the following is a credible insider source for what a great reset will look like is hard to confirm. But it follows existing predictions of UN Agenda 2030, the WEF published goals and rings true in terms of analyzing our current economy and psychology. Click the pictures to view the article.

The scenario above appears to describe events that occur after the economy has locked up, bank accounts have frozen with transactions allowed at certain times, certain days, prices for goods and services have skyrocketed, and mass poverty, hunger, and death are accelerating daily. Or it could happen at the onset of the inevitable debt implosion and be instituted as an immediate fix, to save the population from inevitable ruin.

Resetting Wealth The Other Reset Option

If everyone in the US decided to pull their money out of banks tied to the Federal Reserve and become their own central bank. If the people began trading, building, farming, and buying outside of the banking system. And if the Federal Reserve were stopped from printing one more unit of debt on a screen, a different kind of Great Reset would unfold.

If the Fed were forced to stop printing today, it would be a complete surprise to the system. The economy would immediately lock up, and again there would still be trade disruptions as well as living and food desperation, with one important difference. Perhaps 30% of the world’s assets, would still be outside of bank/corporate/government ownership and control in the debt system, based on stats today.

The debt system would be collapsing. A wealth system would struggle to emerge. Funding for enforcement, as it currently exists today outside of existing treasury funds, would immediately dry up as well. There would be inter-corporate and inter-government agency struggles worldwide. Agencies and corporations would be forced to fight over the funds and authority over assets that were immediately held and secured. No new money would automatically be authorized, stalling all aspects of government and business activity tied to the debt system. Fights over authority would be the rule.

Those people outside of the debt system will have more ability then to make agreements with their assets between each other and enforce them outside of government or other disputed and/or unlawful interventions. As the stock market crashes, the assets of many former great leadership interests will struggle with the crashing debt system. Many assets will be available then at wholesale. A wealth economy would have a chance to emerge. The great reset as currently outlined would be impossible to fund. If strong enough, independent asset holders could leverage or replace the debt system leaders and interests, with constitutional economic government authorities, over time.

Building A New Economy

Both reset choices are hard. The WEF economic/social system unfolding in the view of many, exists as a result of the debt funding priorities, and lifestyle addictions of the People. For those people seeking to immediately stop the Federal Reserve from printing another digit on a screen, it is a matter of the people’s initiative versus their inertial. How many they wonder, will continue to safely go along and see what happens next, until the predictable conclusion? And how many will say enough is enough? But there is another consideration. How many people know how to become their own central bank, to build an economy from the ground up, using available tools and resources, in the first place?

Tools - Everybody Can Know To Become Your Own Central Bank

Everybody knows how to live in the existing debt economy. It is well reported though the rules are changing more and more. So we will focus on building a do-it-yourself wealth economy. Here are some basic wealth economy building blocks

Get out of debt. Use debt units to acquire hard and soft assets of all kinds including metals, food/energy production, and storage capacity, as well as connections with like-minded people. Acquire tools, self-sufficiency, production, marketing, and survival skills as assets. Trade and increase your assets. Learn what the central banks and their funded governments are doing on a daily basis to limit asset availability and trade to adjust all your strategies for arising opportunities.

For a Clearer Understanding Of A Wealth Based System

Becoming your own central bank is a phrase from reporter Greg Mannarino. He believes the key to building a wealth economy is to love one another, care about each other and be charitable. Investing what you have to grow your wealth while investing with and enabling others to do the same, then giving from your profit to help those most in need is a good overall cultural and market strategy.

Greg tracks central banks and covers all these economic matters daily on YouTube

SHockER! MORE FAKE DATA AND STOCKS ARE POISED TO TAKE OFF!!! Very Important Updates. Mannarino

___________________________________________________________________________

EVERYBODY KNOWS ITS THE PEOPLE’S CHOICE

If you are holding 10 million in wealth and earn 2 million a year, you may be, as the great reset picture text above suggests, the holder of sovereign rights in the new system and therefore be in favor of a new centralized central bank debt system reset. Also if you believe that the rank and file of civilization has lost the ability to meaningfully use available sophisticated tools to build advanced culture from the ground up, you may believe the new debt banking system, run by experts is the best, no matter what you are required to do to make it work.

If on the other hand, you do not see the banking solution as just and fair or do not earn 2 million dollars a year giving you sovereign rights in the new system. If you see decentralized solutions, in the hands of the creator’s inventors and engineers, builders, maintainers, and users of our advanced tools managed outside of centralized control, as the only functional future for civilization. And/or if you simply believe the debt system is bad for humanity, you will likely want to end the Federal Reserve, eliminate its power immediately, and begin to build wealth with others more systematically.

And everybody knows that you're in trouble

Everybody knows what you've been through

From the bloody cross on top of Calvary

To the beach of Malibu

Everybody knows it's coming apart

Take one last look at this Sacred Heart

Before it blows

And everybody knows