Federal Reserve Statement Signals Path To Small Business Extinction

New Study Published by the Federal Reserve

A recent study, published by the Federal Reserve states: Persistent inflation is a headwind for small businesses. Greg Mannarino asks; Did we need a Fed study to tell us that? How much did we pay for that restatement of common economic knowledge, I wonder, hmm?

Powerful Vested Interests Vs Common Sovereign Interests - A Global Resource Cage Match, To The Death | Their Cage Under Their Evolving Rules

If the Federal Reserve is right, then their policies in conjunction with the European Central Bank, (ECB), and other central banks around the world, spell the death of small business. While the Fed is continually touting small business as the foundation of the US economy, on its official website, the ECU is coming out and predicting the future of small businesses worldwide.

EUROPEAN CENTRAL BANK SAYS, INFLATION WILL BE HIGHER, FOR LONGER THAN PREVIOUSLY FORECAST

ALERT! "Liquidity Crisis." BANKS ARE SEEKING ANOTHER LIFELINE FROM THE FED. Mannarino

Both the Western central banks and the BRICS nations are continuing to print debt or borrow from those that do. The Federal Reserve prints dollars, just to lend to foreign countries’ central banks.

Liquidity Problems?

Can the world’s central banks be printing and lending so much money that we are having a liquidity problem? Greg Mannarino reports, linked above.

Yes. The reason is the small banks have no business going on. No loans, and shrinking deposits.

GREGORY MANNARINO - SEP 13, 2023

Lions and friends…

I just heard from an old friend, and THIS is his text to me, (below).

This is a WARNING to us all.. GET UN-BANKED!

My Wells Fargo Bank account was closed yesterday by the bank without warning. No communication, no email, no text, no phone call. $13000 is being sent to me via USPS not FedEx. My social security deposit will not come to me until November. Please tell everyone it can happen to them. No recourse. Account closed. Too bad for me....De-Banking

People are beginning to de-bank. It is becoming a growing trend.

Withdrawing Cash, keeping money in cash, and other assets

Savings. No one is keeping money in a bank savings account

Bank Treasuries. No renewal and little sale of bank treasury notes and funds

Both the personal and commercial real estate markets are depressed. This and other factors are resulting in fewer and fewer loans being issued by smaller banks.

Although the Federal Reserve website offers a range of small business credit application strategies, they are more restricted and the lending cost is higher for small businesses, relative to large corporations and institutions.

Fed Bailout For Powerful Interests, Common Interests Will Pay For

Smaller banks are looking for a Fed bailout. Powerful, globally invested interests, want to consolidate the banking industry. This means weaker banks failing and being absorbed into bigger and then still bigger institutions as the collapse/consolidation unfolds. Presently, smaller banks are not permitted to borrow wholesale from the Fed as the larger banks do.

Many depositors as a result of this will have their bank accounts disrupted for a time and many previous notes and investments sold through the banks will receive pennies on the dollar. To avoid this people are beginning to seek banks based on real assets, and the stable assets of other depositors, not dependent solely on the Fed for liquidity. But a common interest banking system, modeled along the lines of the original Manufacturers Bank and Trust models today hard to find.

Sovereign, Common, Interest Banking

Banks, like a manufacturer’s trust model, used to be actually based primarily, on the resources of their manufacturers, their companies, investors and depositors, and participating workers. Deposits and monthly savings withdrawal of their workers’ projected paychecks, and the bank’s total savings and investment in all areas of manufacturing development and loans. The goal being, enterprise advancement, to the benefit of the bank and the sovereign, common interests of its primary customers.

But as the means to manufacture, or teach science related to engineering with facts outside of official ideology, manufacturing in the US has been greened away to nearly nothing by globally invested interests. The Central Bank fed debt-based note is now more secure to a bank than the real assets of manufacturing for its bank customers to benefit from in America. As a result, real sovereign, common-interest banks, based on real assets from the customer base, are difficult to form and find.

Sovereign Common People Still Hold Real Assets

The globally invested interests are not finished with the wealth transfer they began with the formation of the Federal Reserve in 1913, under the act of the same name. Those in control of the financial/political system globally comprise 1% of the world’s population. Sovereign common interests are the rest of us. We are divided and it is increasingly unlawful to amalgamate, resources and trade, outside of the central bank’s global agenda. We are forced to value all assets and record transactions in central bank notes, within central bank regulations for the benefit of their FDIC member banks.

Farmer’s Markets trading is slowly evolving into an asset resource bank of a kind, where real assets are still allowed to be transacted and recorded through banks at present. It currently constitutes a potential safe model for asset growth. Why? The more customers the producers have, the more land and assets they can accumulate to create more products food, etc. People are not only buying food, they are buying food security in the form of stable production for the rancher farmer, and growth potential. Thus long-range food security for the customer. As people buy in bulk, two or more families, with one freezer have the ability to buy naturally grown meat, at a similar or lower rate than the supermarket. Most ranchers will deliver one cow to the freezer of your choice, butchered, and packaged. This is cost savings.

Food as a basis for a kind of asset banking, is a model that can be applied to other areas as well.

Sovereign Common Interest Banking - Farmer’s Market, New Order

Based on a farmers market, taken to the next level. A region has a bank with primary investors and customers.

Primary Base

Small and Mid-Sized businesses

Their Employees

Small and middle-sized manufacturing, crafts, and specialties.

Farmer’s Markets ranchers, producers, and their customers

Core Depositors/Investors are made up of hard science and alternative media professionals. Scientists, engineers/ technicians, alternative media enterprises, their technical, engineering assets, and personnel

Precious Metals, and natural resource investment traders

Real Estate and +Landowners

All of them banking for sovereign, common interests, and asset security.

You have a bank based on real assets and security for customers with a lot of investment options.

Bank Trading Desks and Packages - Expanding the Farmer’s Market Model

Out common interest bank will need to hold its own real assets in the form of gold, metals, resources, real estate interests, equities, etc., and specific rights over the assets from depositors and investors, to represent a core economic growth asset development for the base and the bank.

The bank will be able to set up trading desks, oversee trade, and garner a small percentage from trade facilitation and potential profit. Our bank will be able to develop investment packages from qualified potentially profitable deals made at the trading desks, to be available to customers to invest in. Trading desks would allow trading between the base to develop agreements among themselves and trading from the base with the bank directly.

At the Land and Real Estate trading desk, for instance, customers could trade their available commercial and other land for all kinds of things, as with ranchers and farmers for instance. Farmers who own land, and or have a successful business model and want more land to develop could trade. This would result in an expanded production base, which could be turned into, savings or investment accounts like food savings accounts. Interest is to be paid in debt currency or other asset resources, based on current and future production. Food bearing, interest accounts, with food payments each month, or int3rchangeable food dollar interest percentage to accumulate in the future for withdrawal, based on a percentage of existing and future supplies and production. Our common interest bank would approve all trading desk-based savings and investment accounts for customers.

We haven’t even touched on the small business, manufacturing, tech engineering trading desks, and the mutual interests in developing idle commercial, suburban, and rural real estate at those trading desks. Product development from all desks could be developed at the media and marketing trading desk. Then there is the precious metals and resources trading desk, which will have assets to trade with all other desks constituting the primary bank asset customer/investor base.

Just an idea that in the end would likely require a lot of lawyers. This pooling of resources and making business deals on a global level is basically what the central banks do.

The point is if people with common interests were banking the same way now, real asset, common interest banks would advance or decline based on their performance and customer base. Successful banks would naturally set a standard practice model. This real asset banking system would want to pool its resources and back a national real asset-based, official US trading currency to replace the dollar.

If people right now, pooled their resources with big depositors and made deals like the central banks do, to advance their enterprise and family interests, then, even with transparent record books, we would be accused of insider trading. Go figure.

A Time Banking Model

Reinette Senum pioneered a community time asset bank based on community assets.

ASSET-BACKED COMMUNITY BETA TEST

Back in 2014, I was concerned about the economy, though, in relative terms, it was a lot more stable than it is now. Nonetheless, I had concerns, and I knew they were valid: What economic safety net do we have when the dollar ceases to exist and a totalitarian system attempts to be implemented?

During that time, I launched our local TimeBank (not a barter, but an exchange program) in Western Nevada County, CA. For six years, I and an additional administrator operated the TimeBank, holding monthly in-person orientations, potlucks, public outreach events, and weekly newsletters.

We had hundreds of members, a few thousand hours exchanged, and an economic connection to 40 other nations and hundreds of cities and communities worldwide with TimeBank chapters.

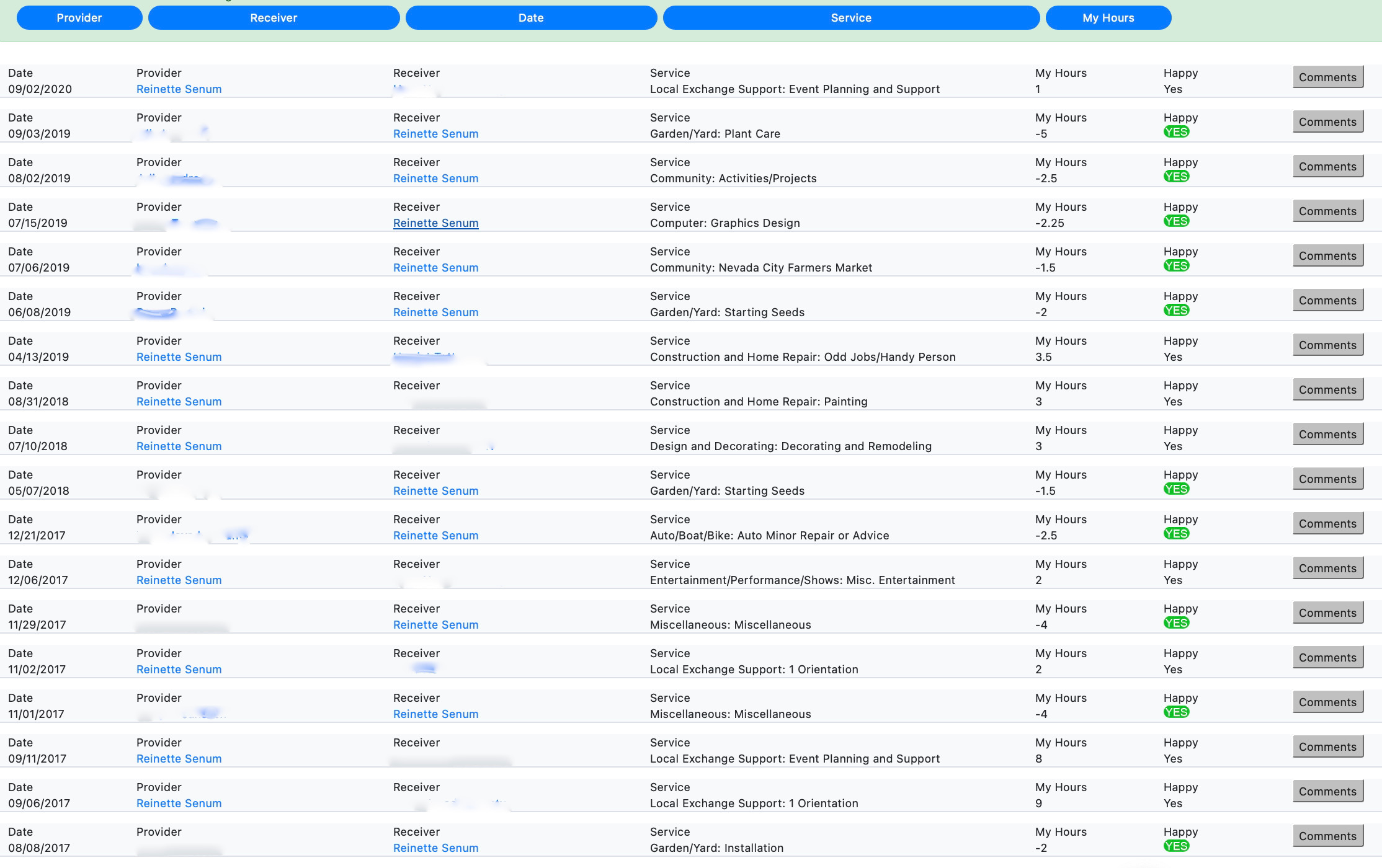

The exchange of services varied widely, and I will give you my personal Hour Nevada County online TimeBank account as an example:

In the world of Timebanking, we equally exchange time for time. Your time is equally valuable as mine, whether you are a dog walker or a dentist READ MORE

Moving on.

Pictures And Articles Potpourri

More of what’s afoot in the world.

Environment

No longer working for NASA, Dr. Roy Spencer is free to write a scholarly work exposing the fundamental flaw in official climate models.

SITYS: Climate models do not conserve mass or energy

August 21st, 2023 by Roy W. Spencer, Ph. D.

See, I told you so.

read more We need to know how to challenge the “official” green economic inclusion sustainable UN goals agenda, which is based on a science fantasy of incomplete, politically correct data.

Solar Synchronicity

Here are a few more

Long-Term Study of Heart Rate Variability Responses to Changes ...

ncbi.nlm.nih.gov› pmc › articles › PMC5805718

This long-term study examined relationships between solar and magnetic factors and the time course and lags of autonomic nervous system (ANS) responses to changes in solar and geomagnetic activity. Heart rate variability (HRV) was recorded for 72 consecutive ...

Geomagnetic activity with global influence is an essential object ...

hindawi.com› journals › aa › 2019 › 2748062

Geomagnetic activity with global influence is an essential object of space weather research and is a significant link in the section of the solar wind-magnetospheric coupling process. Research so far provides strong evidence that geomagnetic activity affects stock investment decisions by ...

On Health Geomagnetic Disturbances and Cardiovascular Mortality Risk

blogs.biomedcentral.com› on-health › 2019 › 09 › 19 › geomagnetic-disturbances-and-cardiovascular-mortality-riskutm_sourcebmc_blogsutm_mediumreferralutm_contentnullutm_campaignblog_2019_on-health

Short-term geomagnetic disturbances driven by solar activity have been linked to a broad range of adverse health effects. In this blog, author Carolina Leticia Zilli Vieira discusses her recent article, published in Environmental Health, which looks at the effects of GMD on cardiovascular diseases, ..

Sliming The Green Agenda

Foghorn Express reports that the UK, specifically England, is becoming the poster child nation for Agenda 2030 pushback.

ULEZ 'Blade Runners' want to take down 'EVERY one of London’s Sadiq Khan's low-emission cameras'

And this:

Check out Stew Peters latest effort as he conducts two top-notch questioning and listening interviews, with two separate guests, both with outstanding accomplishments

W.H.O. Employee BLOWS WHISTLE: Pandemic 2.0 Imminent, Patriot Act WEAPONIZED Against Americans

vvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvvggggggggggggggggggggggggggg