Silent Weapons For Quiet Wars. An introductory programming manual. OPERATICS RESEARCH TECHNICAL MANUAL. TM-577905 - FULL TEXT and IMAGES Pt. 2

Time Flow Relationships and Self-Destructive Oscillations -continued from Part 1

An ideal industry may be symbolized electronically in various ways. The simplest way is to represent a demand by a voltage and a supply by a current. When this is done, the relationship between the two becomes what is called an admittance, which can result from three economic factors: (1) foresight flow, (2) present flow, and (3) hindsight flow.

1. Foresight flow is the result of that property of living entities to cause energy (food) to be stored for a period of low energy (e.g., a winter season). It consists of demands made upon an economic system for that period of low energy (winter season). In a production industry it takes several forms, one of which is known as production stock or inventory. In electronic symbology this specific industry demand (a pure capital industry) is represented by capacitance and the stock or resource is represented by a stored charge. Satisfaction of an industry demand suffers a lag because of the loading effect of inventory priorities.

Present flow ideally involves no delays. It is, so to speak, input today for output today, a "hand to mouth" flow. In electronic symbology, this specific industry demand (a pure us industry) is represented by a conductance which is then a simple economic valve (a dissipative element).

Hindsight flow is known as habit or inertia. In electronics this phenomenon is the characteristic of an inductor (economic analog = a pure service industry) in which a current flow (economic analog = flow of money) creates a magnetic field (economic analog = active human population) which, if the current (money flow) begins to diminish, collapse (war) to maintain the current (flow of money - energy).

Other large alternatives to war as economic inductors or economic flywheels are an open-ended social welfare program, or an enormous (but fruitful) open-ended space program.

The problem with stabilizing the economic system is that there is too much demand on account of (1) too much greed and (2) too much population.

This creates excessive economic inductance which can only be balanced with economic capacitance (true resources or value - e.g., in goods or services). The social welfare program is nothing more than an open-ended credit balance system which creates a false capital industry to give nonproductive people a roof over their heads and food in their stomachs. This can be useful, however, because the recipients become state property in return for the "gift," a standing army for the elite. For he who pays the piper picks the tune. Those who get hooked on the economic drug, must go to the elite for a fix. In this, the method of introducing large amounts of stabilizing capacitance is by borrowing on the future "credit" of the world. This is a fourth law of motion - onset, and consists of performing an action and leaving the system before the reflected reaction returns to the point of action - a delayed reaction. The means of surviving the reaction is by changing the system before the reaction can return. By this means, politicians become more popular in their own time and the public pays later. In fact, the measure of such a politician is the delay time. The same thing is achieved by a government by printing money beyond the limit of the gross national product, and economic process called inflation. This puts a large quantity of money into the hands of the public and maintains a balance against their greed, creates a false self- confidence in them and, for awhile, stays the wolf from the door.

They must eventually resort to war to balance the account, because war ultimately is merely the act of destroying the creditor, and the politicians are the publicly hired hit men that justify the act to keep the responsibility and blood off the public conscience. (See section on consent factors and social-economic structuring.)

If the people really cared about their fellow man, they would control their appetites (greed, procreation, etc.) so that they would not have to operate on a credit or welfare social system which steals from the worker to satisfy the bum.

Since most of the general public will not exercise restraint, there are only two alternatives to reduce the economic inductance of the system.

1. Let the populace bludgeon each other to death in war, which will only result in a total destruction of the living earth.

2. Take control of the world by the use of economic "silent weapons" in a form of "quiet warfare" and reduce the economic inductance of the world to a safe level by a process of benevolent slavery and genocide.

The latter option has been taken as the obviously better option. At this point it should be crystal clear to the reader why absolute secrecy about the silent weapons is necessary. The general public refuses to improve its own mentality and its faith in its fellow man. It has become a herd of proliferating barbarians, and, so to speak, a blight upon the face of the earth. They do not care enough about economic science to learn why they have not been able to avoid war despite religious morality, and their religious or self-gratifying refusal to deal with earthly problems renders the solution of the earthly problem unreachable to them. It is left to those few who are truly willing to think and survive as the fittest to survive, to solve the problem for themselves as the few who really care. Otherwise, exposure of the silent weapon would destroy our only hope of preserving the seed of the future true humanity.

Industry Equivalent Circuits

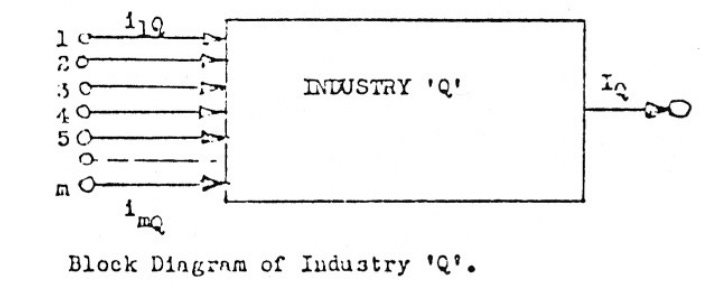

The industry 'Q' can be given a block symbol as follows:

Terminals #1 through #m are connected directly to the outputs of industries #1 and #m, respectively. The equivalent circuit of industry 'Q' is given as follows:

Characteristics: All inputs are at zero volts.

A - Amplifier - causes output current I Q to be represented by a voltage E Q . Amplifier delivers sufficient current at E Q to drive all loads Y 10 through Y mQ and sink all currents i 1Q through i mQ . The unit transconductance amplifier A Q is constructed as follows: *

Arrow denotes the direction of the flow of capital, goods, and services. The total demand is given as E Q , where E Q =I Q .

The coupling network Y PQ symbolizes the demand which industry Q makes on industry P. the connective admittance Y PQ is called the 'technical coefficient' of the industry Q stating the demand of industry Q, called the industry of use, for the output in capital, goods, or services of industry P called the industry of origin.

The flow of commodities from industry P to industry Q is given by i PQ evaluated by the formula:

i PQ = Y PQ * E Q .

When the admittance Y PQ is a simple conductance, this formula takes on the common appearance of Ohm's Law,

i PQ = g PQ * I Q .

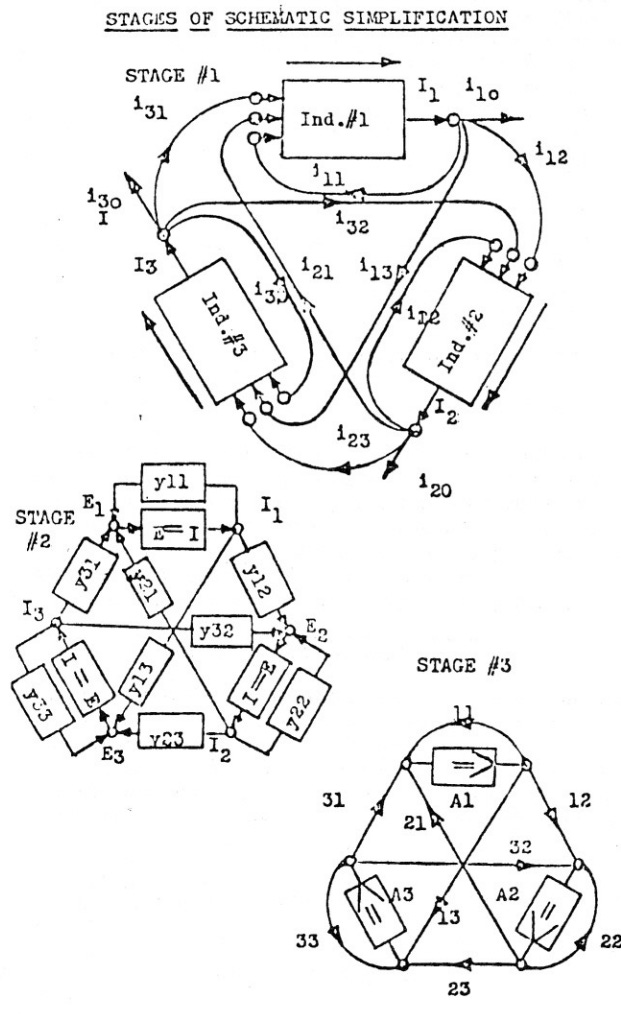

The interconnection of a three-industry system can be diagrammed as follows. The blocks of the industry diagram can be opened up revealing the technical coefficients, and a much simpler format. The equations of flow are given as follows:

Stages of Schematic Simplification

Generalization

All of this may now be summarized.

Let I j represent the output of industry

j, and i jk , the amount of the product of industry j absorbed annually by industry

k, and i jo , the amount of the same product j made available for 'outside' use. Then

Final Bill of Goods

is called the final bill of goods or the bill of final demand, and is zero when the system can be closed by the evaluation of the technical coefficients of the 'non-productive' industries, government and households. Households may be regarded as a productive industry with labor as its output product.

The Technical Coefficients

The quantities y jk are called the technical coefficients of the industrial system. They are admittances and can consist of any combination of three passive parameters, conductance, capacitance, and inductance. Diodes are used to make the flow unidirectional and point against the flow. g jk = economic conductance, absorption coefficient y jk = economic capacitance, capital coefficient L jk = economic inductance, human activity coefficient

The Household Industry

The industries of finance (banking), manufacturing, and government, real counterparts of the pure industries of capital, goods, and services, are easily defined because they are generally logically structured. Because of this their processes can be described mathematically and their technical coefficients can be easily deduced. This, however, is not the case with the service industry known as the household industry.

Household Models

When the industry flow diagram is represented by a 2-block system of households on the right and all other industries on the left, the following results:

The arrows from left to right labeled A, B, C, etc., denote flow of economic value from the industries in the left hand block to the industry in the right hand block called 'households'. These may be thought of as the monthly consumer flows of the following commodities. A - alcoholic beverages, B - beef, C - coffee, . . . . , U - unknown, etc. . . The problem which a theoretical economist faces is that the consumer preferences of any household is not easily predictable and the technical coefficients of any one household tend to be a nonlinear, very complex, and variable function of income, prices, etc. Computer information derived from the use of the universal product code in conjuction with credit-card purchase as an individual household identifier could change this state of affairs, but the U.P.C. method is not yet available on a national or even a significant regional scale. To compensate for this data deficiency, an alternate indirect approach of analysis has been adopted known as economic shock testing. This method, widely used in the aircraft manufacturing industry, develops an aggregate statistical sort of data. Applied to economics, this means that all of the households in one region or in the whole nation are studied as a group or class rather than individually, and the mass behavior rather than the individual behavior is used to discover useful estimates of the technical coefficients governing the economic structure of the hypothetical single-household industry. Notice in the industry flow diagram that the values for the flows A, B, C, etc. are accessible to measurement in terms of selling prices and total sales of commodities. One method of evaluating the technical coefficients of the household industry depends upon shocking the prices of a commodity and noting the changes in the sales of all of the commodities.

Economic Shock Testing

In recent times, the application of Operations Research to the study of the public economy has been obvious for anyone who understands the principles of shock testing. In the shock testing of an aircraft airframe, the recoil impulse of firing a gun mounted on that airframe causes shock waves in that structure which tell aviation engineers the conditions under which some parts of the airplane or the whole airplane or its wings will start to vibrate or flutter like a guitar string, a flute reed, or a tuning fork, and disintegrate or fall apart in flight. Economic engineers achieve the same result in studying the behavior of the economy and the consumer public by carefully selecting a staple commodity such as beef, coffee, gasoline, or sugar, and then causing a sudden change or shock in its price or availability, thus kicking everybody's budget and buying habits out of shape. They then observe the shock waves which result by monitoring the changes in advertising, prices, and sales of that and other commodities. The objective of such studies is to acquire the know-how to set the public economy into a predictable state of motion or change, even a controlled self-destructive state of motion which will convince the public that certain "expert" people should take control of the money system and reestablish security (rather than liberty and justice) for all. When the subject citizens are rendered unable to control their financial affairs, they, of course, become totally enslaved, a source of cheap labor. Not only the prices of commodities, but also the availability of labor can be used as the means of shock testing. Labor strikes deliver excellent tests shocks to an economy, especially in the critical service areas of trucking (transportation), communication, public utilities (energy, water, garbage collection), etc. By shock testing, it is found that there is a direct relationship between the availability of money flowing in an economy and the real psychological outlook and response of masses of people dependent upon that availability. For example, there is a measurable quantitative relationship between the price of gasoline and the probability that a person would experience a headache, feel a need to watch a violent movie, smoke a cigarette, or go to a tavern for a mug of beer. It is most interesting that, by observing and measuring the economic models by which the public tries to run from their problems and escape from reality, and by applying the mathematical theory of Operations Research, it is possible to program computers to predict the most probable combination of created events (shocks) which will bring about a complete control and subjugation of the public through a subversion of the public economy (by shaking the plum tree).

Introduction to the Theory of Economic Shock Testing

Let the prices and total sales of commodities be given and symbolized as follows:

Commodities Price Function Total Sales alcoholic beverages A A beef B B coffee C C gasoline G G sugar S S tobacco T T unknown balance U U

Let us assume a simple economic model in which the total number of important (staple) commodities are represented as beef, gasoline, and an aggregate of all other staple commodities which we will call the hypothetical miscellaneous staple commodity 'M' (e.g., M is an aggregate of C, S, T, U, etc.).

Example of Shock Testing

Assume that the total sales, P, of petroleum products can be described by the linear function of the quantities B, G, and M, which are functions of the prices of those respective commodities.

Then

P = a PG B + a PG G + a PM M

where B, G, and M are functions of the prices of beef, gasoline, and miscellaneous, respectively, and a PB , a PG , and a PM are constant coefficients defining the amount by which each of the functions B, G, and M affect the sales, P, of petroleum products.

We are assuming that B, G, and M are variables independent of each other.

If the availability or price of gasoline is suddenly changed, then G must be replaced by G + G. This causes a change in the petroleum sales from P to P + P. Also we will assume that B and M remain constant when G changes to G + G.

(P + P) = a PB B + a PG (G + G) + a PM M.

Expanding upon this expression, we get…

P + P = a PB B + a PG G + a PG G + a PM M

and subtracting the original value of P we get for the change in P

Change in P = P = a PG G

Dividing by G we get a PG = P / G .

This is a rate of change in P due only to an isolated change in G, G. In general, a jk is the partial rate of change in the sales effect j due to a change in the causal price function of commodity k. If the interval of time were infinitesimal, this expression would be reduced to the definition of the total differential of a function, P.