Market Fundamentals No Distractions - Mannarino, Activist Post

The Social/Economic Structure of the Debt Economy, Central Banking System

Why do we keep saying, stop the central banks, stop the central banks, would you please stop the central banks already?

STOP THE BANKS FROM PRINTING ETERNAL DEBT

I probably sound like I say this all the time. That’s probably because I do. But for a guy like me, who thinks they have it all figured out, I’m discovering there is no easy solution, and the only way out is to pull the plug. But for someone who has never considered the true structure and ongoing state of the global central bank debt system, it sounds a little wide-eyed and a bit scary as well.

And it would be scary to stop the banks from printing. No question. If the central banks, just one of them, the Federal Reserve for instance, stopped printing, the economy would instantaneously freeze globally, and banks would close. Public services would struggle to remain functional. Food ad energy would be stuck in the pipeline, not getting to market. Pretty bad. But isn’t that the point? How could so few people in the banking system hold that much power over the world? And should they?

Where Does The Money Come From? Who Owns A Majority of the World’s Assets?

No one really knows who holds enforceable control over the majority of the world’s assets. Is it the Jews, Chinese, Christians, Fascists, Historic Royal Banking interests, and Jews, Aliens, Angels, and Devils? All good prospects. They are, in the opinion of this newsletter, immaterial to the problem of elite control over the economic system. In our opinion, the world could live just fine without borrowing against their assets, who so ever assets they are.

What we do know is that the people we do know like national governments, Klaus Schwab, Bill Gates, the chairpersons of the Federal Reserve, and the leaders of business and civics, are not them. They are the people we see handling their affairs, profiting in debt currency, and promoting their plans. But they are not necessarily them. In fact, it could be said that anyone, enterprise, or thing, that is valued in central bank-controlled assets, including government currencies, stocks, and bonds, is likely not the elite.

In fact, I would say, worrying about who they are at this point is a distraction and a tool for division. Jews and Marxists, Whites, gay and green agendas, wars, and worse, all use the various divisions of opinion about who is in control to distract from our very real slavery in the system to debt. If we stop the banks from printing, the criminal elite will have a hard time hiding, and we will know better who to arrest and why. Like many elite things, given their track record, we will possibly discover, many of the elite have been hiding in plain sight.

Central Banks Issue Debt Backed By Elite Assets

The owners of the majority of the world’s assets, set up central banks, and people to run them. They did so in the U.S. under the Federal Reserve at the beginning of the 20th century. They do not own all the assets in the world, but they want the central banks to own all of the world’s assets on paper, and the banks are acquiring assets at an increasingly rapid rate this century.

How The Central Banks Control the World, Through Debt Financing of Global Policy

We will look at the fundamentals of the global debt structure through the eyes of Greg Mannarino.

I arrived at Greg’s point of view about 8 years ago, without his marketing expertise. Greg defined the elements I saw, and had names and rules for how they naturally operate in the markets. So at this point in the newsletter, I think the best I can do is rephrase his observations, but not as well. So here is a recent article he published this week on the Central Banking System that gives a great overview.

Central Banks Have Declared WAR On the World. By Gregory Mannarino

From Greg M

Jan 30

Lions and friends…

Please feel free to share this.

Today world central banks are at the pinnacle of their power, they are the puppet masters, they make the rules, and they run the entire world.

Central banks have total control over the entire world financial system, modes of transactions, the world economy, and world markets. All central banks power resides in only one thing, and one thing only, and that is their ability to issue and manipulate debt.

Central banks use the global debt market itself, which is many multiples larger than the combined value of world stock markets, to set the price of other assets. In fact, the price action of EVERY other asset class, which includes stocks and real estate, are dictated by the price action in the debt market. The debt market consists of the issuance and purchase of debt instruments, like bonds for example, which pay a fixed amount to the buyer. The simplest way to think about the debt market is this, it’s a market of IOU’s. The seller of debt promises to pay a fixed amount on the debt they are selling in the future to the buyer. In the case of central banks, it’s nations who borrow, which then promise to pay back the debt issued by central banks- plus interest created out of thin air just like the debt itself.

No developed nation on Earth can function without ever increasing and expanding debt, for which central banks are more than happy to “lend.” This mechanism guarantees that collectively central banks power will forever increase. This entire mechanism is compounded upon by central banks issuing currency. The currency issued by a central bank are also IOU’s which are owned by the issuing central bank plus interest created out of thin air. The cash people “hold” in their wallets, bank accounts, etc. is not theirs! It’s owned by the issuing central bank which MUST be paid back plus interest. READ MORE

I also liked his report yesterday evening.

W.H.O. WARNS: "Governments Prepare For Nuclear War." Critical Updates Markets And More. Mannarino

Debt Dependency of the Bond And Stock Markets, Mortgaged Backed Securities

Greg gives a great overview. He sums up the fundamentals in a way that is understandable. But if you are a natural skeptic it still can seem a bit theoretical. If you have been following Greg’s work over the last 2 years, you have seen many details of how the transfer of wealth has occurred, through central bank practices. However, if you are new to this, this next article hits the subject out of the theoretical ballpark. It is a blow-by-blow account of how the wealth has been transferred. From Activist Post.

Don’t Call It Capitalism: The Fed’s $8 Trillion Hoard of Financial Assets

TOPICS: Free MarketRyan McMakenThe Fed

JANUARY 29, 2023

By Ryan McMaken

It’s a sure bet that as the economy worsens, unemployment surges, foreclosures rise, defaults climb, and economic misery ensues, we’ll be told it’s all capitalism’s fault. The question one must ask, however, is, “What capitalism?”

The claim that “too much” capitalism drives every economic calamity is standard among anticapitalists on both the left and the right. They have many bullet points claiming government programs and government spending are everywhere retreating while free-market capitalism is experiencing a resurgence. This can be easily shown to be empirically false. Evidence can be found in everything from the continual flood of government regulations to rising per capita taxation and spending to the growing army of government employees. That’s all in the United States, mind you, the supposed headquarters of “free-market capitalism.” We might also point to how the US welfare state, including the immense amounts of government spending on healthcare and pensions, is on a par with European welfare states in terms of size. The supposed lack of social benefits programs in the US has long been a myth. The trend in spending, taxation, and regulation is unambiguously upward.

In recent years, though, one additional indictor of just how little capitalism is actually going on has surfaced: central banks around the world are buying up huge amounts of financial assets in order to subsidize certain industries, inflate prices, and generally manipulate the economy. This is certainly true of the American central bank, the Federal Reserve.

How the Federal Reserve Came to Dominate Financial Asset Markets

While the Fed has long bought government debt in its so-called open-market operations to manipulate the interest rate, wholesale buying of financial assets began in 2008. READ MORE

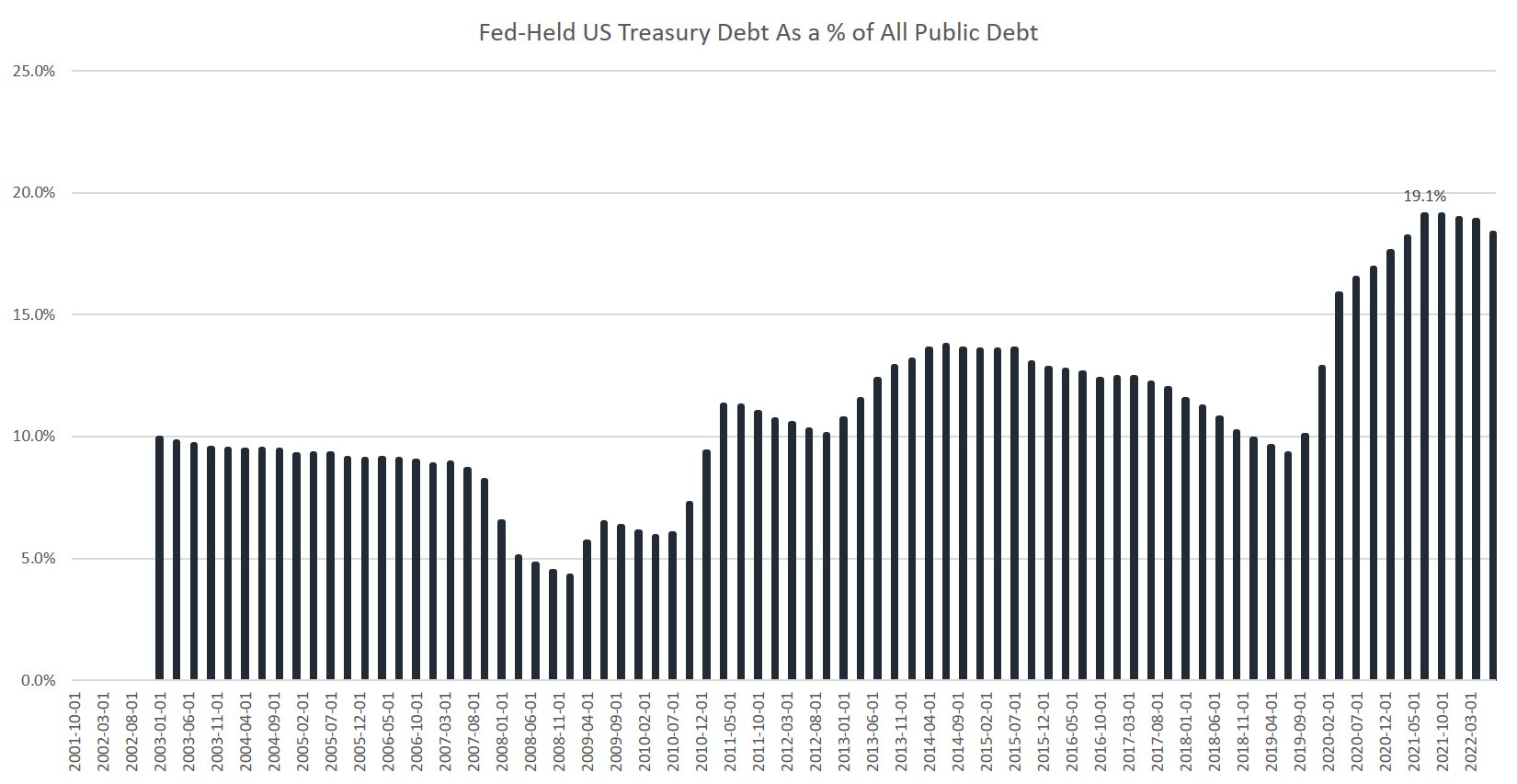

Do you like charts? I know I do. Here is one from the article. No question they are printing record debt and acquiring record assets. This is the bond market alone. The bond market as both Greg and Ryan McMaken observe, determines the actions of all other markets.

What I think is important to remember here is that this is nearly 20% of all assets accounted for in the debt economy. This does not reflect all of the underlying foundational assets, the banks use from the majority asset holders, of the earth’s resources, to lend into the system that they now, also own nearly 20% of. Also that a majority of these assets in bonds, stocks, commodities, and mortgaged-backed securities, are owned on paper by roughly 3% of the world’s population.

Hidden Assets And Influence

In other words, many of the assets used to set up central banks originally were not accounted for on paper against new debt issued to governments and government banks. But they were deemed, producible on demand, for a price. This remains the case today as all central banks hold private books outside of public view. Not all assets are accounted for then in these public records.

One goal of the People when central banks are forbidden from printing will be to secure and seize those private bank records.

Commodities, The Assets Of the Future, Now

As we know, the debt system has to systematically collapse now and again due to printing unlimited debt based on limited assets. When you control the assets you can engineer the collapses in your favor. So because the people who run the debt system actually own hard assets, you should too, if you want to profit and be independent of any system’s built-in failures, there are many hard assets and commodities available.

Gold, precious metals, food independence, energy independence. These are the assets that those who do not lose out when the system routinely collapses rely on. You should too. Blockchain currencies too, while we still have electricity.

Commodities long term. Stocks and enterprises that hold or deal in commodities that maintain consistent relative value. Seed storage and production, energy storage, etc.

Owning Land

It is assumed by the system that all land traded and accounted for in the system is subject to the system. The system then will try to limit your use and ownership of land in many ways, if you are not ready. But control in some manner by individuals over land use for food, industry, and individual/community production is vital, and a privilege held by the elites. The system is creating more political and economic justifications for limiting land ownership, and even confiscating property.

Land acquisition strategy should be centered around ownership or land rights in like-minded, states, communities, and districts, and transact outside of banks when feasible.

Who has always been the primary purveyor of usury throughout history?

Who has always funded both sides, be it the right/left, democrats/republicans, axis/allies, West/China?

Who today primarily influences, dominates, and/or owns 3 sectors necessary to control the world: 1)The money? 2) The perception-management narrative? 3) The technology?

If you can't ID the bottom-line perpetrators, how can you possibly defend yourself, let alone defeat them? Behind sins of omission (or disproportionate downplaying), are limited hangouts.

Background references for #1

https://www.corbettreport.com/how-blackrock-conquered-the-world-part-1/

https://www.unz.com/lromanoff/the-richest-man-in-the-world/